Delaware Statutory Trust (DST) 1031 Explained

A Delaware Statutory Trust, commonly known as a DST, is a legal trust structure created under Delaware law and recognized by the IRS as a qualified replacement property for a 1031 exchange under Revenue Ruling 2004-86. It is a popular tool for property owners looking to complete a 1031 exchange while enjoying the benefits of passive real estate ownership.

A DST typically includes a trust document, trustee, master tenant, beneficiaries, and the property itself. While these terms can sound complex, the structure is similar to familiar roles in traditional real estate transactions.

The sponsor of the DST, who may also act as the trustee or appoint an affiliated company to do so, acquires the property and forms the DST. This role is similar to an individual purchasing a property for personal ownership. The tenant is the party occupying the property, just as in a traditional rental arrangement. The master tenant is responsible for managing the property, collecting rent, and subleasing to the tenant, similar to the role of a property manager in personal real estate ownership.

Once the DST is established and undergoes a thorough due diligence process, it is offered to the public for investment. The DST holds the underlying real estate, while each investor, known as a beneficial owner, owns a percentage of the trust. For 1031 exchange purposes, the IRS considers the investor to directly own the real estate, but in practice, the investor remains a passive participant with no authority to make decisions on behalf of the DST. This protects all investors from liabilities caused by the actions of others within the trust.

Beneficial owners receive a proportional share of the net income, tax deductions, and any appreciation or depreciation in the property’s value. DSTs offer several advantages over direct property ownership, such as:

- Access to high-quality, investment-grade real estate like shopping centers, industrial facilities, and office buildings with national tenants providing reliable income streams.

- The ability to earn cash flow without the responsibilities of property acquisition and management.

- Avoiding the burdens of toilets, tenants, trash, and telephone calls.

- Limited personal liability, as loans are typically non-recourse, meaning investors are not personally liable for the debt.

However, DSTs also involve fees and risks that investors should evaluate. Fees are disclosed in the private placement memorandum and may include acquisition, management, and operating expenses. Risks are similar to direct real estate ownership, including market fluctuations, tenant vacancies, potential changes in tax laws, and reliance on the trustee’s performance. There is also no guarantee that the property’s value will appreciate.

For investors ready to step away from active landlord duties, seeking diversification, and still wanting to own real estate, a DST can be an excellent option within a 1031 exchange strategy. Before investing, it is important to fully understand the benefits and potential risks, and to consult with experienced financial and legal advisors to ensure it aligns with your investment goals.

What Does Like-Kind Property Mean?

The term “Like-Kind” pertains to the category, and not the specific type, of asset that qualifies for 1031 tax-deferred treatment. Gain on the sale of assets categorized for investment purposes that are used in a trade or business can be sold and the gain can be deferred if new assets are purchased to replace the assets that were sold, and all 1031 rules and regulations are met.

This can cause confusion, as some investors might think “Like-Kind” means if you sell a specific asset held for investment such as a commercial office building, you must purchase a commercial office building to meet IRS 1031 tax-deferred exchange “Like-Kind” asset requirements. But this is not true. Any asset in the “Like-Kind” category will qualify as a suitable replacement property.

For example, a single family rental can be exchanged for raw land, or apartments or a commercial building.

In addition, properties can be exchanged anywhere within the United States. In addition, “Like-Kind” property can include Tenant-In- Common (TIC) and Delaware Statutory Trust (DST) real estate investments.

Do I have to Actually “Exchange” Real Estate Simultaneously?

No, a 1031 tax-deferred exchange can be completed as a simultaneous exchange meaning one asset is sold and a new asset is purchased in the same transaction, a delayed exchange meaning Property One is sold first and Property Two is purchased later, or a reverse exchange meaning that Property Two is purchased first and Property One is sold later.

API comments that the majority of current 1031 tax-deferred exchanges are completed using the delayed format.

You have to decide to implement a 1031 exchange before Property One is sold. This means that you must establish your 1031 account with a Qualified Intermediary before you close escrow on the property you are selling. You cannot close escrow on your property today and then decide tomorrow to implement a 1031 tax-deferred exchange.

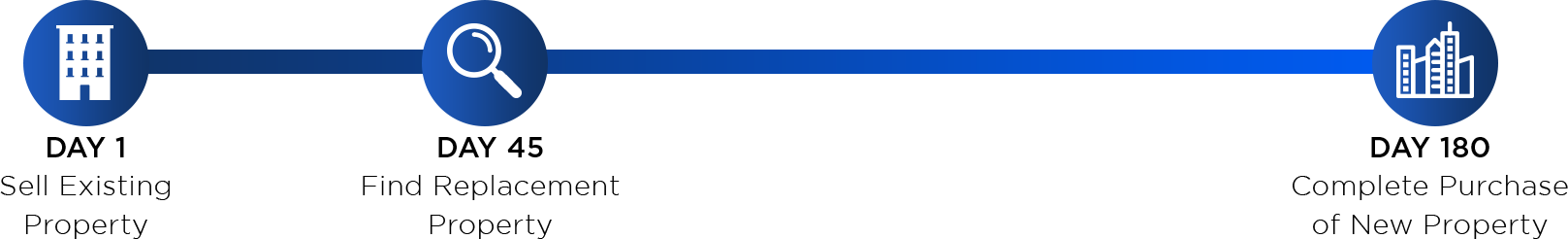

Adhering to the time requirements of Internal Revenue Code Section 1031 is extremely important. Important 1031 tax-deferred exchange dates are all calculated from the date Property One closes escrow:

- From the date Property One closes escrow, you have a maximum of 45 CALENDAR DAYS to name the next property, Property Two, you plan to buy.

- From the date Property One closes escrow, you have a maximum of 180 CALENDAR DAYS to close escrow on Property Two that you named in the initial 45-day period.

- In some cases, sellers may not receive the full benefit of the entire 180 days if the due date for their tax return in the year following the sale occurs prior to the end of the 180 day period. In that case, the taxpayer would need to file an extension in order to have the benefit of the full 180 days.

What About the Equity From The Sale Of Property One?

To receive a full deferral of income taxes, property Two must receive 100% of the net equity proceeds that came out of Property One. The sales proceeds for Property One must go from the title/escrow company directly to your Qualified Intermediary. You must not receive any funds from the buyer of your property or from the title/escrow company. Funds you receive are “boot”, and are generally subject to income taxes.

It is important to understand that receiving funds from the sale of Property One does not invalidate your 1031 tax-deferred exchange, but it will potentially subject the amount you receive to income taxation.

To Defer All Taxes, Can Property Two Cost Less Than Property One?

Property Two must cost at least as much as much as what Property One sold for. To benefit from 100% income tax deferral, you cannot “trade down” from Property One into Property Two. The IRS allows full tax deferral only if you buy a replacement property of equal or greater value. “Trading Down” to a lower priced Property Two does not invalidate your 1031 tax-deferred exchange, but it will potentially subject you to income taxation on the decreased cost of Property Two as compared to Property One.

Property Two must have at least as much debt as Property One unless you pay down the new debt with extra cash. Having less debt on Property Two does not invalidate your 1031 tax-deferred exchange, but it will potentially subject you to income taxation on the decrease of debt on Property Two as compared to Property One.

Is a 1031 Tax-Deferred Or Tax-Free?

A 1031 tax-deferred exchange is tax-deferred, it is NOT tax-free. It is important to understand that although income taxes can be deferred currently on the sale of Property One, when Property Two is sold in the future there could be income taxes to pay at that time. It is also important to understand that when Property Two is sold at some time in the future, income taxes on the gain from the sale of Property Two could be higher, and reduce or eliminate the income tax benefits from the sale of Property One.

It is very important to understand that there are many costs related to selling Property One, buying Property Two, and in executing a properly structured 1031 tax-deferred exchange. These costs must be carefully reviewed and studied because these costs could easily surpass any income tax benefits a seller of real estate could receive in a 1031 tax-deferred exchange transaction.